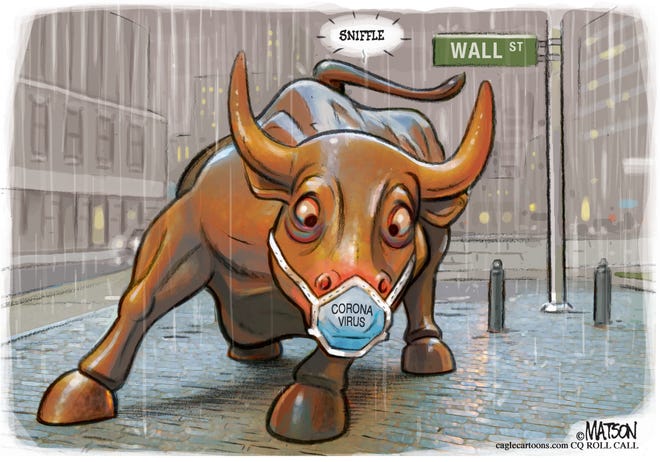

U.S. equity markets were shoved into their fastest correction in history this week as fears of the coronavirus becoming a pandemic rattled investors and stoked recession fears.

Seven days of heavy selling, including two from the previous week, left the major averages licking their wounds from their steepest weekly plunge since the financial crisis.

“If we get this into the pandemic stage, we are going to have a recession,” Scott Minerd, managing director and global chief investment officer at Guggenheim Partners, which oversees $270 billion in assets.

“Europe has probably already slipped into a recession and China is clearly in a recession at this point. It’s just a matter of how long it takes to hit our shores.”

The coronavirus outbreak, which originated in Wuhan, China, has sickened at least 83,694 people and killed 2,861 in 53 countries, according to the latest figures from the World Health Organization.

The fast-spreading nature of the virus caused the lockdown of hundreds of millions of people in China, paralyzing supply chains and causing demand destruction for everything from oil to iPhones to automobiles.

No comments:

Post a Comment