Former Federal Reserve Chair Janet Yellen said the markets may be wrong this time in trusting the yield curve inversion as a recession indicator.

"Historically, it has been a pretty good signal of recession, and I think that's when markets pay attention to it, but I would really urge that on this occasion it may be a less good signal," Yellen said on. "The reason for that is there are a number of factors other than market expectations about the future path of interest rates that are pushing down long-term yields."

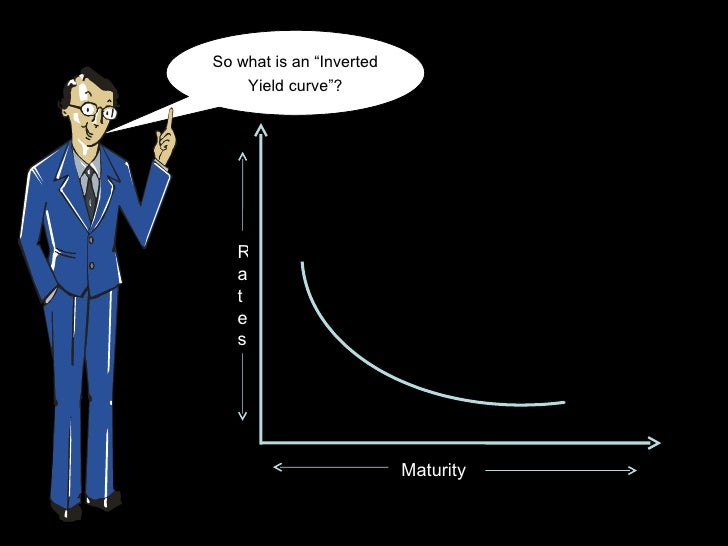

The yield on the benchmark 10-year Treasury note was at 1.623% on Wednesday, below the 2-year yield at 1.634%, causing the bond market's main yield curve to invert and send markets plummeting.

The bond market phenomenon is historically a trusty signal of an eventual recession; however, Yellen said this time may be different.

The bond market phenomenon is historically a trusty signal of an eventual recession; however, Yellen said this time may be different.

No comments:

Post a Comment