JPMorgan's views of the virus "have evolved dramatically in recent weeks" as the outbreak has spread further, the bank's economists wrote.

The US economy could shrink by 2% in the first quarter and 3% in the second, JPMorgan projected, while the eurozone economy could contract by 1.8% and 3.3% in the same periods.

Technical recession is defined as two consecutive quarters of negative gross-domestic-product growth. The bank's emerging-markets economists haven't updated their growth estimates, but "evolving news on the virus and the material tightening" in those markets' financial conditions make it "reasonable to expect further downward revisions" in global first-half GDP.

The outbreak was initially deemed a short-lived but disruptive shock to world economies, but two key developments led the bank to brace for a "much sharper" contraction in the first half of the year and a "novel-global recession."

The economists first cited the "sudden stop" to economic activity created by quarantines and social-distancing measures around the world.

The cancellations of major sporting, cultural, and business events will further cut into consumer spending, and the uncertainty surrounding the virus will make a coordinated economic restart even more difficult, the economists said.

The cancellations of major sporting, cultural, and business events will further cut into consumer spending, and the uncertainty surrounding the virus will make a coordinated economic restart even more difficult, the economists said.

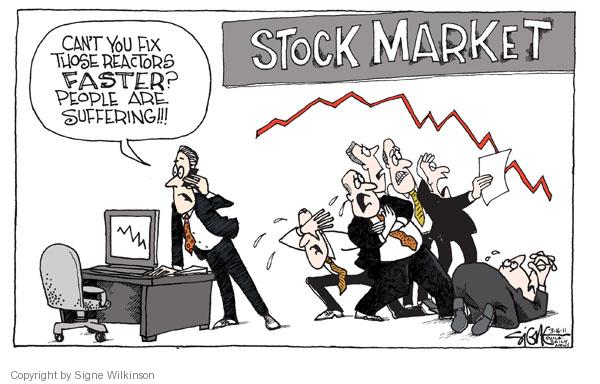

Financial markets' wild price swings and tumbling asset prices will also contribute to economic contraction over the next two quarters, according to JPMorgan. Financial conditions around the globe are "tightening sharply as perceptions of credit quality" across several assets deteriorate, the economists said. The risk of sovereign and corporate debt crises adds to the firm's already dire economic outlook.