Sunday, November 21, 2021

U-Turn...

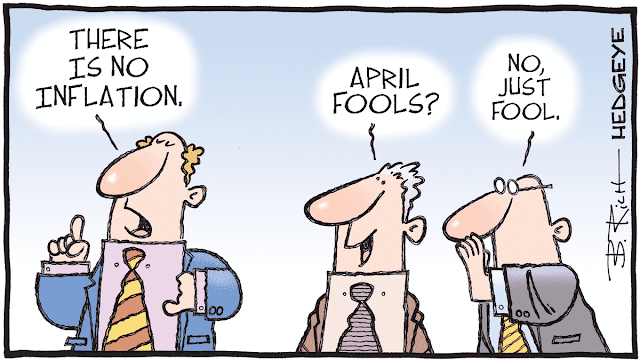

“If the Fed suddenly gets tougher, I’m not sure that the market is going to be ready for a U-turn that [chair] Jerome Powell may take if we have one more bad inflation report,” the Wharton finance professor told CNBC’s “Trading Nation” on Friday. “A correction will come.”

The consumer price index surged 6.2% in October, the Labor Department reported earlier this month. It marked the biggest gain in more than 30 years.

Siegel criticizes the Fed for being far behind the curve in terms of taking anti-inflationary action.

“Generally, since the Fed has not made any aggressive move at all, the money is still flowing into the market.” “The Fed is still doing quantitative easing.”

He speculates the moment of truth will happen at the Fed’s Dec. 14 to Dec. 15 policy meeting.

If it signals a more aggressive approach to contain rising prices, Siegel warns a correction could strike. Despite his concern, Siegel is in stocks.

“I am still pretty fully invested because, you know, there is no alternative,” he said. “Bonds are getting, in my opinion, worse and worse. Cash is disappearing at the rate of inflation which is over 6%, and I think is going higher.”

Siegel anticipates rising prices will stretch out over several years, with cumulative inflation reaching 20% to 25%.

Un-Ruley...

Kyle Rittenhouse, who fatally shot two men and wounded another amid protests and rioting over police conduct in Kenosha, Wis., was found not guilty of homicide and other charges.

After about 26 hours of deliberation, a twelve jury panel accepted Mr. Rittenhouse’s explanation that he had acted reasonably to defend himself in an unruly and turbulent scene in August 2020,

Mr. Rittenhouse sobbed and was held by his lawyers after a clerk read the jury’s verdict, acquitting him of all charges.

The question is,

How unruly was the crowd?

How many rioters walked the street carrying guns or various weapons?

Just a thought.

Upside...

And hospitals in Erie County reports 227 patients, a 23% increase.

Hochul earlier this week warned that a continued uptick in COVID-19 rates could mean New Yorkers will again face more virus protocols in high-risk communities.

Low Risk...

Fight...

Just a thought.

Saturday, November 20, 2021

Crashed...

Trump's interventionist approach continued in April 2020 when oil prices crashed below zero for the first time ever.

Realizing that dirt-cheap oil prices threatened jobs in key Republican states, Trump did an incredible shocking 180 and successfully urged OPEC slash oil production.

Who...

Shocked...