Inflation will stay low.

Agricultural commodity prices, excluding meats, have crashed. Corn, wheat and soybean prices have plummeted on expectations of bumper crops around the world particularly in the United States. Heavy rains in the growing regions have altered the outlook for drought-stricken areas (except California) and have led to a major decline in prices.

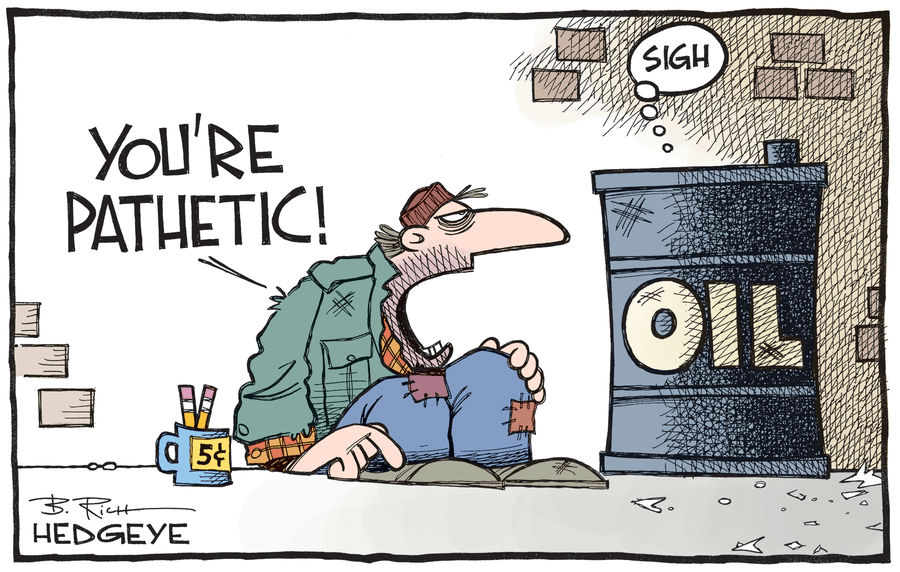

Energy prices have also dropped from recent highs close to $90 a barrel to $50. Natural gas prices have slumped to below $4 per thousand BTUs. Milder summer weather, and burgeoning supplies of natural gas, have caused prices to crash.

Interest rate and the slope of the yield curve. The yield on the 10-year Treasury note is below 2.5%, as the yield curve is flattening. Wage inflation, is also a non-starter. Wages are rising at a 2 percent to 2.5 percent annual rate, hardly the stuff of wage-price spirals.

The velocity of money, from the St. Louis Fed, is near zero. It needs to accelerate markedly to make the case that policy-inspired inflation is on the horizon. [August 15, 2014]

This may be coming to an end, except the oil. Just a thought.